Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

People nowadays have become more and more interested in digital lenders. However, many have started wondering whether these companies are actually any good. On that note, is AmeriSave a good mortgage company? AmeriSave is a good mortgage company. They offer…

Navy Federal Credit Union is a full-service lender specializing in loans reserved for military members, their families, and veterans. If you’re looking to take out a loan, you might wonder – what credit score does Navy Federal use? Navy Federal…

Mortgage calculators have become useful tools for assessing your financial situation and capabilities before applying for a loan. However, they have certain disadvantages that mustn’t be overlooked and it is important to know what the most accurate mortgage calculator is.…

Yes, a home equity loan can be called by the lender, requiring immediate repayment of the outstanding balance. This action can be triggered by scenarios such as default on payments, a significant drop in property value, or violation of loan…

Yes, a bank can act as a mortgage broker. While banks typically serve as direct lenders, some offer brokerage services by working with outside wholesale lenders to find loans for borrowers. These banks analyze the borrower’s situation, shop rates from…

Getting a loan for a new home is probably one of the most significant financial decisions you will make in your lifetime. This is why it is important to know what you are looking for and from whom. There are…

When you take out a mortgage from a lender like a bank, you likely assume you’ll be making payments to that same institution for the entire length of the loan. If you’ve ever received notice that your mortgage was sold to another entity, you may have…

If you are aspiring to become a successful mortgage broker or a person who is looking for the services of a trustworthy one, it is important in both cases to ask – “What is a mortgage broker bond?”. A mortgage…

Are you getting ready to apply for a mortgage and are concerned about your credit score? Your credit score can be a very important determining factor when it comes to the rate and costs of your mortgage, so it’s important…

Making a down payment on a home is often the biggest hurdle for prospective homebuyers. While down payments typically range from 3-20% of the purchase price, coming up with such a large amount of cash is difficult for many, especially first-time homebuyers. If…

Yes, a bank can sell your loan. This involves transferring the legal rights and obligations of your loan contract to another institution or investor. The original bank sells the right to collect payments and interest from you to another entity.…

A mortgage is one of the most significant financial decisions an individual or family can make. There are two main options for obtaining a home loan – working directly with a lender or going through a credit broker. Understanding the…

Capital One is the six-largest bank with over 25 years of experience in the industry. So, if you’re looking for a reliable credit card company, before choosing this bank, answer one question – What credit score does Capital One use?…

Is Loans Direct legit? This is one of the questions you need to have to answer when dealing with some of the financing processes. If you’re a newbie and applying for a mortgage or loan for the first time, you…

People who are looking for the best deal for a loan to maintain or purchase land, a home or othepar types of real estate surely have already heard of Better.com. But is Better Mortgage a broker, and what does it…

When it comes to financing, there are many things you’ll have to consider just to be sure you’re making the right move. Of course, you’ll first look for all the information online, and Better Mortgage is certainly one of the…

Good Mortgage has been in the loan industry for over two decades; they were founded in Charlotte, NC, in 1999. Sometimes, though, years of experience can’t make up for good management, which seems to be the case with GM. So,…

Credit One Bank is a credit card company that’s been in business since the 1980s. It offers credit cards to low-credit customers, and since its beginnings, it has developed twelve different cards with various benefits. You can get a card…

When you take out a loan from a bank or other financial institution, you may not realize that the lender has the ability to sell that loan to another company. This transfer of ownership can happen with various types of loans, including mortgages, home equity loans, personal…

Mortgage packagers can be a huge help when buying a home. They can work with you to get the best mortgage for your needs. But what exactly is a mortgage packager, and what do they do? What is a mortgage…

For anyone who wants to get their hands on affordable loans and mortgages, searching for the right lender can be frustrating. Today, we will look at the pros and cons of AMCAP, a mortgage company from Houston, TX. Here are…

A+ Mortgage is a direct lender offering various mortgage loans and services like pre-approval, rate-lock, down payment assistance, refinancing, and online applications. Customer reviews highlight their fast processing times, responsive loan officers, competitive rates and smooth process. However, some customers…

Finding the right mortgage lender or mortgage broker can be a daunting task when buying a new home or refinancing your existing mortgage. With so many options to choose from, it’s hard to know which mortgage company is the best fit for your specific needs and budget. …

If you’re looking for a reliable bank, you may be wondering if Navy Federal or Wells Fargo is the better option. Both of these banks have a lot to offer, but there are some key differences that can help you…

Having reliable lending practices by your side, other than affordable mortgages and loans, is surely something to have in mind when you plan to deal with any kind of financing process. And we all know how finding a trustworthy lender…

Selecting the right mortgage lender is one of the most important steps when buying a home or refinancing an existing mortgage. The lender you choose can greatly impact interest rates, fees, loan options, and the overall experience. Doing thorough research…

One of the conditions for getting pre-approved for a mortgage is to have a good credit score, which means that you should have as few debts as possible. However, many who are currently renting their places wonder – is rent…

If you are looking for lenders, Zillow can help you with that. Here are Zillow's best mortgage lenders in each state.

American Express Rocket Mortgage offer is eligible exclusively for Card Members. With it, you unlock more options and make the experience more rewarding.

Whether you want to improve your new home or cover repair bills, Rocket Mortgage cash-out refinance may be the perfect answer to all your needs.

With Zillow 30 year mortgage rates, potential homebuyers can see how much they would pay. Find out the newest trends.

Wish to know the difference - mortgage broker vs. real estate agent? Here is an explanation of what you will get from both professionals.

Buying a home is a complex process, and understanding every part is essential. Here's all you need to know about Rocket Mortgage closing costs.

Find out all there is to know about Zillow mortgage leads and, most importantly, whether buying leads on Zillow is worth the money you spend.

Want to know all there is about Zillow mortgage appraisal? You came to the right place. In this comprehensive guide, we will answer all your questions.

Want to know Zillow Bank of America mortgage reviews? You don't need to look for yourself - we did it for you. Keep reading and find out.

Getting a loan and buying a new home can be a lengthy process. But Charles Schwab Rocket Mortgage can be the right solution tailored to your needs.

Want to know what is a first lien HELOC and how it is different from a second HELOC? You came to the right place - here is all you need to know about HELOC

If you wish to know how to cancel recurring mortgage payments at Wells Fargo, you came to the right place. Here we will show you all the ways you can do it.

If you wonder can you lock the mortgage rate, you came to the right place. We will tell you how and when is the best time to lock your rate.

Want to know is a reverse mortgage a loan? You came to the right place. We will explain all there is to know about this type of loan.

Want to know is Wells Fargo a mortgage bank? You came to the right place - find out all there is to know about Wells Fargo.

Wondering what a mortgage broker does and is Rocket Mortgage a broker? You came to the right place. We will answer your questions and much more.

If you wish to know is mortgage tax tax-deductible, you came to the right place. We have explained all the ways you can get tax returns when owning a property.

If you wish to know, is a HELOC a mortgage, you came to the right place. We have answers to this and many more questions.

Let us show you what is 5 mortgage are and how you can find the best loans that will fit your needs perfectly.

How long does mortgage approval take? Find out how long you will need to wait before getting notified on whether your application is approved or denied.

Purchasing a home is often the largest financial investment that many people will make in their lifetime. Along with a mortgage comes the responsibility of ensuring that your dependents and loved ones are taken care of in the event of your death. This is…

Want to know does Rocket Mortgage affect credit? You came to the right address. We will explain everything about the credit score there is.

Thinking about taking credit to buy a house? Find out all about adjustable-rate mortgage pros and cons before you make the decision.

If you wish to know does Rocket Mortgage do FHA loans, you came to the right place. We will answer all your questions regarding FHA and Rocket Mortgage loans.

Check out our guide, learn how Rocket Mortgage pre-approval works, what it means, and how you can get started.

Does Rocket Mortgage sell their loans to investors, or do they cover all the financing themselves? Here's everything you need to know about this topic.

If you want to know how are mortgage points paid, you came to the right address. This guide will tell you all there is to know about discount points.

Getting a loan is a process, but how long does a mortgage application take? Learn more about the duration and requirements of your loan application here.

Understanding the cost of mortgage insurance is an important part of the home buying process for many homeowners. Mortgage insurance has a significant financial impact, so it’s essential to know how it works and how much it costs. The cost…

You wish to know if escrow tax property tax? Well, you came to the right place - here you will find out all you need to know about escrow.

Are you wondering: how do I get my mortgage deed? All you need to know is thoroughly explained in this article.

Does a mortgage expire? If you’re planning to buy a house soon and see a mortgage loan as the way of doing so, ensure to find out the answer.

Mortgage as a topic is not common knowledge. If you wish to learn more, going through the best mortgage books is your safest bet - and here they are.

If you’re planning to buy a home soon, find out if you can finance a mortgage down payment and how to do so to achieve the best possible outcome.

When is the best time to apply for a mortgage? Find out the answer so you can get only top service and rates when you decide to take this step.

Does mortgage insurance go away? Loans and all the costs that go with them are pricey, so many look to cut their costs in any way possible.

Do mortgage lenders use FICO to evaluate your credit score? If you're looking for a loan, providing the lender with your credit history is a must, and here is how this works.

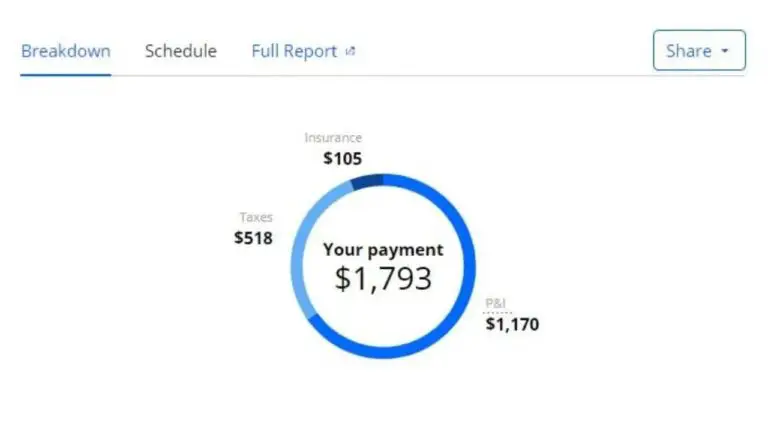

A mortgage payment is the amount you pay each month to service your home loan. This includes principal, interest, taxes, and insurance. Lowering your mortgage payment can free up room in your monthly budget and help you achieve financial goals…

Getting approved for a mortgage is an important step in achieving homeownership. With mortgage approval, you can purchase your dream home and begin building equity. However, the mortgage approval process can be complex and competitive. Understanding what lenders look for…

Mortgage closing costs are the various fees associated with finalizing a home loan. These costs are paid at closing and can add thousands of dollars to the total cost of buying a home. According to data from ClosingCorp, the average closing…

When getting your credit score checked, your credit history, payment history, and other factors are considered. This is all done to ensure that you’re eligible for a mortgage lender’s loan requirements. The majority of mortgage lenders use FICO 8. All…

There are a myriad of mortgage companies, and they all share a common goal. Their goal is to provide you with a quick loan and high-quality service along the way. And Mr. Cooper Mortgage is a company that excels in…

Looking for a way to get a quick mortgage loan? Movement Mortgage has gained its reputation through its mortgage options and turnaround time for quick loans. If you’re asking, “what is movement mortgage?” We have the answers for you. Movement…

Property taxes occur to every homeowner. Sometimes they can be expensive based on the value of your property and if any pre-existing liens are placed on it. New homeowners tend to ask, “What is a mortgage exemption? A Mortgage exemption…

Getting mortgage insurance is an extensive process. Even if you own a property, you’ll still have to pay for hazard insurance. For new homeowners, we’ll answer the “Is hazard insurance mortgage insurance?” question right here. Hazard insurance is a part…

A hard inquiry is when a financial institution like a mortgage lender requests your credit report from one of the three major credit bureaus – Experian, Equifax or TransUnion. This occurs when you apply for new credit like a mortgage, auto loan…

Mortgages are one of the most common methods of financing home purchases in the United States. For many homeowners, their mortgage is their single largest debt. Paying off a mortgage faster can have major financial benefits, allowing homeowners to own…

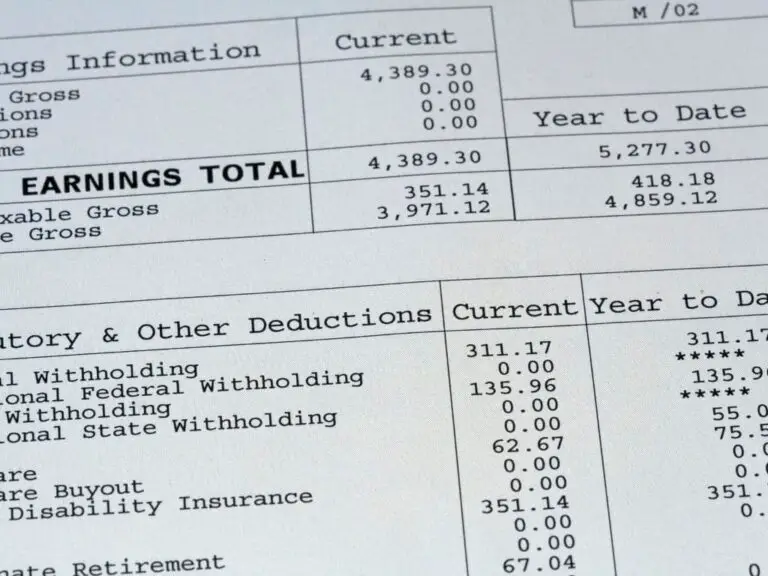

Tax returns refer to the forms and documentation filed with the Internal Revenue Service (IRS) each year to report an individual’s or business’ income, deductions, and tax liability. For mortgage applications, tax returns serve as a vital component in verifying a prospective…

Purchasing a home is often the biggest financial investment an individual or family will make. The mortgage loan application process requires applicants to thoroughly demonstrate their financial reliability to lenders. A critical component in illuminating income and verifying financial stability…

A reverse mortgage allows eligible homeowners aged 62 and older to convert part of their home equity into cash without having to sell their home or take on a new monthly mortgage payment. It can provide retirees with extra income to help supplement Social Security or meet unexpected expenses. However, reverse mortgages also…

Saving for a mortgage down payment is an important step in the home buying process. Selecting the right savings account to grow your funds can make a big difference in how quickly you reach your goal. When comparing savings accounts…

A mortgage is likely the largest loan you’ll ever take out in your lifetime. With so much at stake, it’s important to understand the key differences between mortgage companies and banks when choosing where to get your home loan. While…

A voluntary lien is a type of lien that a property owner voluntarily grants to a creditor. One of the most common types of voluntary liens is a mortgage. A mortgage is a loan used to finance the purchase of…

If you're buying a new home, one of the most common questions will be: are property taxes included in a mortgage? Here is a definitive guide with all the answers.

Is a mortgage a deed of trust? If you are in the process of getting loan approval and want to know all the essential details, check out my simple guide.

Are you thinking about buying a house or property and want to know is mortgage a loan? We have explained the main difference, so you don't have to dig.

Are you planning to buy land and wonder can you mortgage land? Find out the answer to this and many more questions you may have.

Learning how to pay off a 30-year mortgage in 15 years will help you avoid spending your hard-earned money on interest.

If you're looking for a loan, then you'll have to know what is a comparison rate mortgage, why is it important, and how it can help you learn the true cost of a loan

Do you know what a mortgage broker does and what their role in the loan application process is? If you're buying a home, here are all the answers you need.

The primary question “How much mortgage can I afford?” is an important one for homebuyers to consider carefully. Assessing one’s financial situation and determining a suitable and manageable mortgage amount is essential for responsible homeownership. There are several key factors…

A mortgage is a loan used to purchase real estate, with the property acting as collateral. The mortgage rate and interest are key components that determine the cost of borrowing and monthly payments for homebuyers. Understanding how mortgage rates and…

One of the best-known insurance policies new homeowners have to pay is mortgage insurance premium (MIP). So, how is mortgage insurance premium paid, and what does it represent? Mortgage insurance premium is paid at closing and annually for as long…

A credit history refers to a record of how an individual has borrowed and repaid debts over time. This includes credit cards, auto loans, student loans, and other types of credit. Credit history is a crucial factor that mortgage lenders…

A mortgage agreement is a legal contract between a lender and a borrower that establishes the terms of a loan used to purchase real estate. The mortgage agreement allows the lender to claim rights to the property if the borrower…

During a close on a mortgage loan, you may hear the words ‘closing costs’ and ‘mortgage points.’ Since both are payments provided after the closing, you may wonder – are mortgage points closing costs? These two could be confused, but…

Buying a home is an exciting milestone in life. However, the process of buying real estate can also be complex, especially when it comes to legal ownership of the property. Many homeowners wonder if they truly own their home if they have a mortgage. The answer lies in…

The escrow account is an integral part of the mortgage process. When you take out a mortgage loan to buy a home, your lender will likely require you to set up an escrow account to pay for property taxes and homeowners insurance. But how exactly does this work? Does the…

For many homeowners, the monthly mortgage payment can be confusing, with multiple components like principal, interest, taxes and home insurancebundled together. A key part of the mortgage payment for some is the escrow account, which collects funds on behalf of the lender to pay expenses like property…

Mortgage assumption is the process of legally transferring an existing mortgage loan from the seller of a home to the buyer. When a mortgage is assumed, the buyer takes over the remaining balance and becomes responsible for repaying the loan.…

Taking out a mortgage when purchasing the house of your dreams is a risk that needs a lot of thought due to the complexity of the purchase and the sheer volume of factors you have to consider. We, as humans,…

If you have already done your research, you know that finding the best mortgage rates and negotiating are crucial factors in ensuring an affordable price for your dream home, but you have more likely than not stumbled upon another term.…

A mortgage is a loan used to finance the purchase of a home or other real estate. The mortgage provides the borrowing power to purchase a more expensive property than one could otherwise afford. Mortgages are secured with collateral –…