Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Buying a home represents one of life’s most significant financial milestones. The path to homeownership requires careful planning, disciplined saving, and strategic decision-making. Whether you’re a first-time buyer or looking to upgrade your living situation, proper financial preparation can make…

Bank statements are among the many documents that lenders will want to see when you apply for a mortgage. A quick overview of your assets, expenses, and income is given to lenders by bank statements. Depending on the lender and…

Home insurance is an essential type of insurance that provides financial protection for homeowners against damage or loss to their home and belongings. With home insurance, homeowners can have peace of mind knowing that they are shielded from the high…

A credit score is a three-digit number that lenders use to assess your creditworthiness for loans and credit cards. It gives lenders an idea of how likely you are to repay debt based on your borrowing and repayment history. Credit…

JPMorgan Chase Bank offers many conveniences to its clients, such as cashback on their Freedom cards, available to all of their card members. Their newest offer includes Chase Freedom Unlimited and Chase Freedom Flex. But what credit score does Chase…

A credit score is a crucial aspect when you want to apply for credit cards, and an excellent score is not always required. There are two cards from JPMorgan Chase Bank that are suitable for beginners in the financial world…

Taking out your first loan is a major financial move that requires careful planning and consideration. Determining just how much you can borrow for that initial loan depends on several key factors related to your financial profile. The amount you…

Your credit score is one of the most important factors that lenders look at when determining your eligibility for a loan. But with so many different credit scoring models out there, it can get confusing. One popular free credit score service is Credit Karma. But do…

Taking out a mortgage to finance a home purchase is one of the biggest financial decisions you’ll make in life. Before applying for a home loan, it’s crucial to understand how much house you can afford and what your estimated…

A home equity loan is a way for homeowners to access the equity they have built up in their home. With a home equity loan, you are essentially taking out a second mortgage on your property and using your home as collateral. This can allow you to…

A home equity loan allows homeowners to borrow against the equity in their home. It is a way to access funds for various needs while using your home as collateral. But can you have more than one home equity loan…

For many prospective home buyers, coming up with a down payment can be one of the biggest obstacles to home ownership. A typical down payment on a home is around 3-20% of the purchase price. With rising home prices in many markets, this can equate to tens…

Financing a barn can seem daunting, but with the right preparation and research, you can find financing options to suit your needs. Yes, you can finance a barn through various options such as personal loans, home equity loans, construction loans,…

Purchasing a mobile home can be an affordable way to own your own home. However, you may find that your manufactured home needs renovations or upgrades after living in it for a while. Financing home improvements for a mobile home can be tricky since these properties…

Your credit score is one of the most important factors that lenders use to evaluate your creditworthiness. Having a high credit score can help you get approved for credit cards, loans, and other financial products with better terms. But understanding where your…

Navy Federal Credit Union is a full-service lender specializing in loans reserved for military members, their families, and veterans. If you’re looking to take out a loan, you might wonder – what credit score does Navy Federal use? Navy Federal…

Are you getting ready to apply for a mortgage and are concerned about your credit score? Your credit score can be a very important determining factor when it comes to the rate and costs of your mortgage, so it’s important…

Capital One is the six-largest bank with over 25 years of experience in the industry. So, if you’re looking for a reliable credit card company, before choosing this bank, answer one question – What credit score does Capital One use?…

Credit One Bank is a credit card company that’s been in business since the 1980s. It offers credit cards to low-credit customers, and since its beginnings, it has developed twelve different cards with various benefits. You can get a card…

One of the conditions for getting pre-approved for a mortgage is to have a good credit score, which means that you should have as few debts as possible. However, many who are currently renting their places wonder – is rent…

Purchasing a home is often the largest financial investment that many people will make in their lifetime. Along with a mortgage comes the responsibility of ensuring that your dependents and loved ones are taken care of in the event of your death. This is…

Want to know does Rocket Mortgage affect credit? You came to the right address. We will explain everything about the credit score there is.

Check out our guide, learn how Rocket Mortgage pre-approval works, what it means, and how you can get started.

If you’re planning to buy a home soon, find out if you can finance a mortgage down payment and how to do so to achieve the best possible outcome.

When is the best time to apply for a mortgage? Find out the answer so you can get only top service and rates when you decide to take this step.

Do mortgage lenders use FICO to evaluate your credit score? If you're looking for a loan, providing the lender with your credit history is a must, and here is how this works.

Getting approved for a mortgage is an important step in achieving homeownership. With mortgage approval, you can purchase your dream home and begin building equity. However, the mortgage approval process can be complex and competitive. Understanding what lenders look for…

When getting your credit score checked, your credit history, payment history, and other factors are considered. This is all done to ensure that you’re eligible for a mortgage lender’s loan requirements. The majority of mortgage lenders use FICO 8. All…

Property taxes occur to every homeowner. Sometimes they can be expensive based on the value of your property and if any pre-existing liens are placed on it. New homeowners tend to ask, “What is a mortgage exemption? A Mortgage exemption…

A hard inquiry is when a financial institution like a mortgage lender requests your credit report from one of the three major credit bureaus – Experian, Equifax or TransUnion. This occurs when you apply for new credit like a mortgage, auto loan…

Tax returns refer to the forms and documentation filed with the Internal Revenue Service (IRS) each year to report an individual’s or business’ income, deductions, and tax liability. For mortgage applications, tax returns serve as a vital component in verifying a prospective…

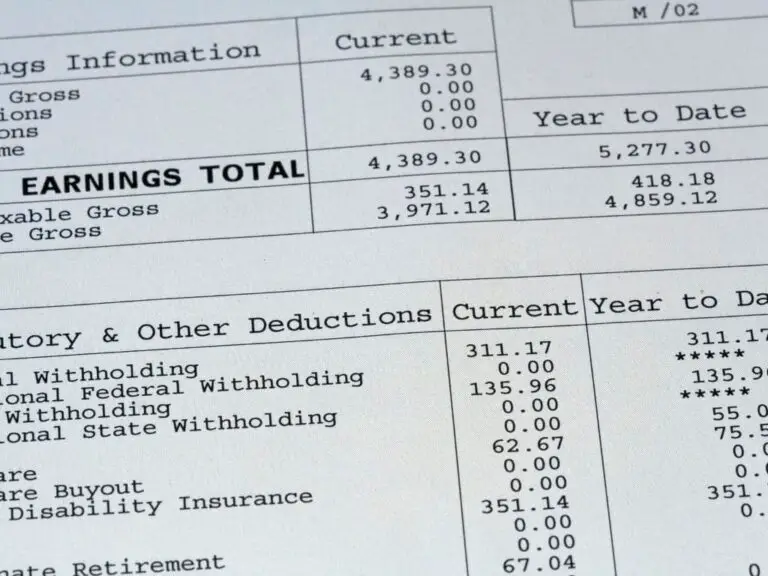

Purchasing a home is often the biggest financial investment an individual or family will make. The mortgage loan application process requires applicants to thoroughly demonstrate their financial reliability to lenders. A critical component in illuminating income and verifying financial stability…

Are you planning to buy land and wonder can you mortgage land? Find out the answer to this and many more questions you may have.

A credit history refers to a record of how an individual has borrowed and repaid debts over time. This includes credit cards, auto loans, student loans, and other types of credit. Credit history is a crucial factor that mortgage lenders…

A mortgage is a loan used to finance the purchase of a home or other real estate. The mortgage provides the borrowing power to purchase a more expensive property than one could otherwise afford. Mortgages are secured with collateral –…

Purchasing a foreclosure can be an attractive option for homebuyers looking to save money on a property. However, financing a foreclosed home has some unique considerations compared to a standard home purchase. You can mortgage a foreclosure. However, traditional lenders may impose stringent requirements…