Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

When buying or selling a house, many people rely on Zillow mortgage appraisal when listing their price. But what is Zillow mortgage appraisal, and what is the difference between that and licensed home value appraisal?

What is a Zillow mortgage appraisal? A Zillow mortgage appraisal is an automated valuation report generated by the Zillow real estate website. The appraisal is based on public data and previous sales of comparable homes in the area. It is meant to provide a preliminary estimate of a home’s value, and is not used for official or legal purposes.

These and many other questions, as well as how the process of home appraisal works, will be answered in this article, so keep reading and find out.

Many real estate agents and sellers will rely on Zestimate. Still, it can happen that the buyer’s bank asks for a licensed appraisal, and this price can be lower than Zillow’s.

To find out what to do in this kind of situation and much more about the whole appraisal process, keep reading.

As we mentioned, Zillow is a real estate company where people can list their homes for sale. This company has a search engine that allows buyers to see listed homes from all over the US.

The website also offers sellers an option to appraise their home value. This is done through Zestimate. Here sellers can see how much their home is worth before listing the price online.

This can be a useful tool for sellers to see an estimate of their home value and decide whether they want to sell or not.

The estimate is done by comparing the market value of the similar properties that were recently sold in that area or similar areas. That is not the same as a home appraisal which is usually asked for by a mortgage lender before they give you approval for the mortgage.

Zestimate uses a formula that combines public data and user data about the property. The more data users give, the estimated value of the property will be more accurate.

According to the Zillow website, the median error rate for all homes listed nationwide is 1.9%, while for off-market homes, the median error is 7.5%. The accuracy depends on the location and the availability of data in that area – the Zillow estimate is only as accurate as the data provided. So, for example, if you don’t enter the right number of rooms or square footage, the price will not be correct.

Also, Zillow uses public records from taxpayers about the property, so if you are paying taxes on a house that was upgraded with one room but without a permit, this upgrade will not be part of the estimate.

Still, people shouldn’t use Zillow estimation instead of the appraisal because this is just a rough estimate to serve as a guideline to the sellers about the price they should list.

There are ways you can make your Zestimate higher than the current market value predictions. We already mentioned that Zillows use public records from taxes paid for certain property.

So, if you do some upgrade in the house that requires a building permit, these upgrades will affect your taxes at the end of the year. Zillow will then use this data for your home value estimate.

On the other hand, if you have done some renovations that don’t require permits, such as refurbishing your kitchen cabinets, this will not end up in the Zillow estimate if you don’t provide this information to the website.

Keep in mind that even if you provide the information, it doesn’t necessarily mean your Zestimate will be higher.

When applying for a mortgage, your lender will ask you for a lot of information, from your FICO score and taxes to your credit history. The lender will also ask for a downpayment and home appraisal. A home appraisal is done by licensed appraisal experts that will estimate the true value of the home you are interested in buying.

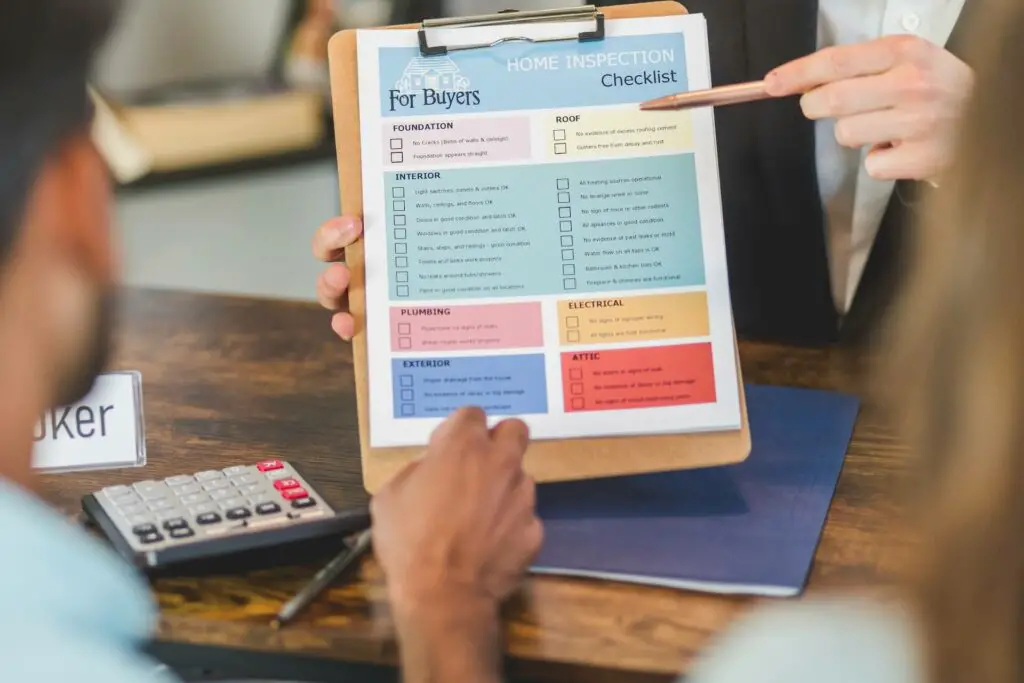

The home’s appraised value will have a huge role in determining whether the lender will approve your loan. A home appraisal is done to protect the lender from giving more money than the house’s actual value. It is also good protection for the buyers, so they don’t end up paying for a house that is not worth the listed price. Here is what appraisal takes into consideration when determining the value of a home:

Even though a home appraisal from an expert is probably the most accurate thing you will get, it is not guaranteed you will sell the house for that price. You can never know how your home will behave on an open market.

For example, you can list your home for a higher price, and maybe you will find a buyer who is willing to pay this difference because he truly wants to live in that area. Or you can end up without any offer because people believe the price is too high.

When you apply for a mortgage, your lender will ask for a home appraisal of the property you wish to purchase. Also, if you wish to refinance your home, some lenders may ask for an independent appraisal as well.

If you are selling a home, you can hire an appraiser to give you an estimate of your home value before you list the house for selling.

On average, appraisal of the home costs between $300 to $400. If you are buying a house through a mortgage, these costs will be added to your closing costs. But naturally, if you are selling a house and wish to have it appraised, you will have to pay this amount to the appraisal expert.

A pre-listing appraisal is when the seller wants to know their home value before they put it up on the market. Some sellers only decide to do appraisals through Zillow, while others prefer to leave a value estimate to an expert, thus avoiding big differences in-home price listing afterward.

Also, before you list your home, you should know there are three different ways property can be assessed:

The CMA or Comparative Market Analysis is a process that only a real estate agent can perform for you. It provides a fair market value for your property. This is usually a free process that your agent can do based on the data gathered from multiple listing services (MLS). It is a place where an agent can see how other agents are listing properties in your area.

When doing the analysis, your agent will look for homes similar to yours in size and other characteristics. CMA will give you a low, medium, and high price for your house and an estimate of the average number of days the house should be listed on the market.

And even though CMA is not an exact science, it can give you some idea of how much you should list your home for. Here are the main differences between CMA and Home Appraisal:

| CMA | Home Appraisal agent | |

| Who can do this? | Only real estate agents | Only appraisal agents licensed by the state |

| What will they look at when making a price? | Other similar homes from the neighborhood | Similar prices in the neighborhood, home condition, location, nearby amenities, age of house |

| Who can hire them? | Seller | Seller, buyer, or lender |

| Can you influence the estimation? | Difficult | You can prepare your home for appraisal to get a higher price |

As we said, Zillow’s tool Zestimate is based on publicly available data and information provided by the sellers. But Zillow has something that is called Zestimate Market Analysis. That is, in essence, CMA that combines Zestimate analysis and analysis of the licensed agent hired by Zillow. This is usually done when an accurate Zestimate is not available.

So how does it work? As soon as the listing is active, a licensed agent will evaluate a home’s facts, such as square footage, number of rooms, and bedrooms, and compare the selling prices of similar properties in that area to provide you with the fair market value of your property.

Just to be clear, Zestimate Market Analysis is not a home appraisal, and buyers may ask for their own appraisal that can be lower or higher than the estimate proved by Zillow.

As you can see, when selling a house, many things must be taken into consideration. Even though your agent will give you some advice on a listing price, in the end, the decision is yours. So, before you set the price, take a look at all the estimations and analyses you got.

Take a look at comps in CMA estimation and see if they are accurate enough. Make sure to gather all the information relevant to your property before you do a Zestimate and list your price.

Another important thing is not to go too much over the price you got from an appraisal. Also, when putting your home on Zillow, make sure to put a round number.

For example, if your home is appraised for $302,000 and you wish to be listed lower for $299,000, your house will not pop out to the buyers who set their max price to $300,000.

If you listed for $300,000, you would not lose potential buyers because of the $3,000 difference.

If you are looking to sign a loan agreement with the lender, you first need to find a house you wish to buy. The listed house will have a price tag that the seller and their agent think is the fair market value.

Your lender will ask for an independent appraisal of the property, and these costs will be part of your closing costs when the mortgage is signed. The price of the home provided by the appraiser will be the amount the lender is willing to borrow you for that purchase.

This appraised value can affect your mortgage by far. For example, if the house you wish to purchase is listed for $300,000 and you have a down payment of $60,000, you’re looking for a $240,000 loan.

But if the appraised price is lower by $20,000, meaning the value of the home is $280,000, and you still have $60,000 for a down payment, your lender will loan you $220,000.

Then you will have to get an additional $20,000 to make that purchase.

If you are a buyer and your appraisal price comes in lower than the listing price, several options are available. First, you can increase the down payment by that difference in price. Most lenders will accept this offer.

The second thing buyers can do is to put less down payment than initially planned. So if you planned to put 20% of the down payment, you could put 10% to make up the difference between the listing price and appraisal price.

This will mean your loan will be higher, and you will have to pay private mortgage insurance until the equity in the home’s value to loan ratio is 20%.

Another thing buyers can do is cancel the contract, and if the buyer signs an appraisal contingency, they can cancel the contract anytime.

Also, there is an option to negotiate the lower price of the house with the seller. This is probably the best option.

As a buyer who is paying for an appraisal, you can always ask your lender to challenge that appraisal. If you, as a buyer, believe that the appraiser used the wrong information or that they’re not familiar enough with that area, you can challenge this and ask for a review of the appraised price.

The seller can also help you with this appeal by providing additional documents such as their appraisal, proof of major improvements around the house, or CMA if they have one.

If you don’t agree with your Zestimate Market Analysis, there is nothing you can do. According to Zillow, you can not change or delete any individual analysis of the home property.

But this Zestimate is no replacement for appraisal, and you should have your agent do the appraisal and CMA before he lists your home.

There are many reasons why appraisal can come in low. For starters, it is usually done by a person who can make mistakes and overlook some major details. Here are some other factors that can influence low appraisal:

As you may know, before you get into the mortgage approval process, you need to have a contract with a seller for the house you wish to purchase. This contract usually comes with a certain deposit you need to give to the seller in case you decide not to go with the deal.

Well, home appraisal contingencyis a clause in the contract that gives you as a buyer a way out of the contract without losing the deposit.

In essence, appraisal contingency notifies the seller that the buyer will have the house appraised, and if the price is not the same as the listed price, the buyer has a right to drop off the contract.

In the end, Zillow’s appraisal is not appraisal at all. It is only an estimate of the house value. It is a starting point for sellers so they can have some sort of idea of how much their homes are valued.

Also, Zillow’s estimate is not 100% accurate, and the company is working on some upgrades so they can overcome these problems. This estimate should only be used as a rough guide, and if you combine that with a Zillow Market Analysis, you will get closer to the true price of your home.

As you can see, even a home appraisal can be inaccurate and challenged both by sellers and buyers. The only downside of Zillow is that it is hard to make any changes once the estimation is done. This is why it is crucial to have accurate and important data for Zestimate.

Overall Zestimate is an excellent tool and, if used in a proper way, it can help you a great deal. Especially if you decide to sell the house on your own without an agent.