Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Zillow Offers was a service from Zillow where they made cash offers to directly buy…

Home insurance is an essential type of insurance that provides financial protection…

A home appraisal is an assessment of a property’s market value conducted…

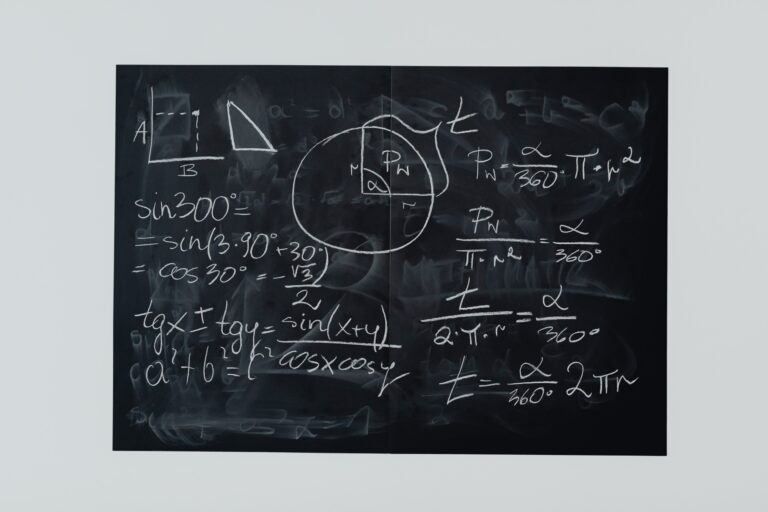

A credit score is a three-digit number that lenders use to assess…

Buying a home is an exciting milestone in many people’s lives. However,…

Mortgage refinancing is the process of paying off an existing mortgage loan with…

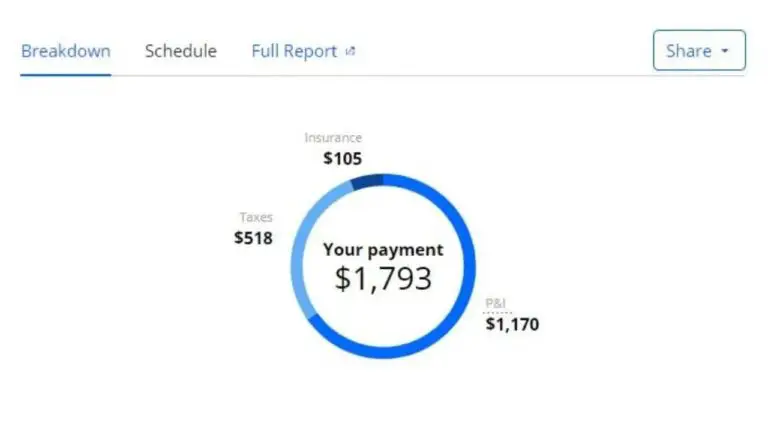

A mortgage is a legal agreement that gives the lender the right to take ownership of…

Mortgage rates refer to the interest rates that lenders charge borrowers for different…

Purchasing a home is an exciting milestone in life. However, the process…

The process of applying for a mortgage loan to purchase a home can seem…

Securing a mortgage to purchase a home is an exciting yet complex…

Do you know if you have to pay your mortgage insurance monthly…

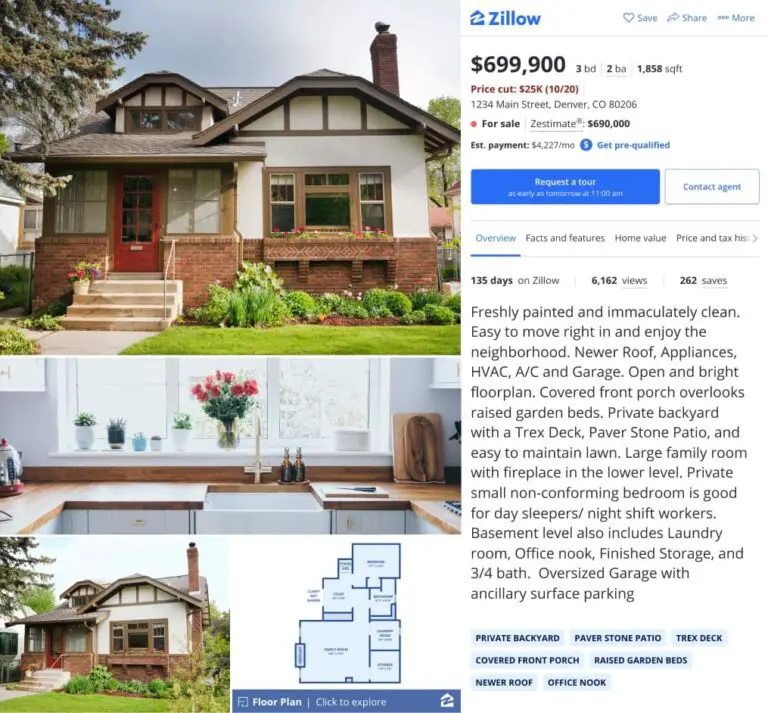

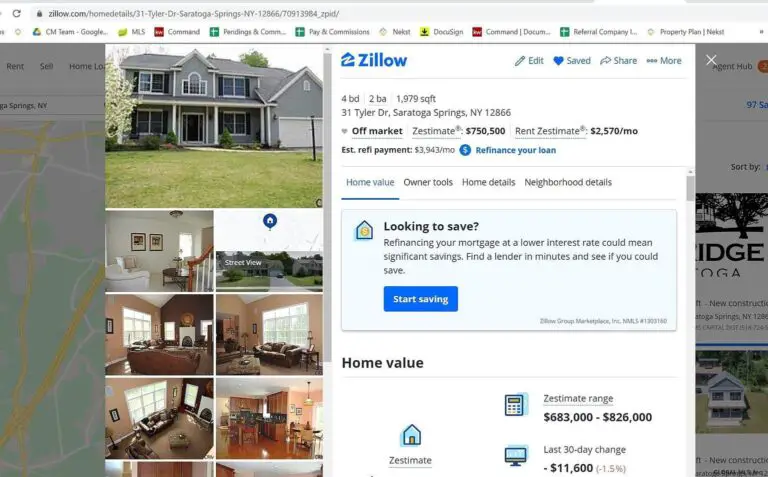

Wondering if you should stick to Zillow to get accurate estimates of…

Taking out a mortgage when purchasing the house of your dreams is…

Buying a home is one of the biggest decisions you’ll ever make.…

Better Mortgage is a loan service provider that helps people get mortgages…

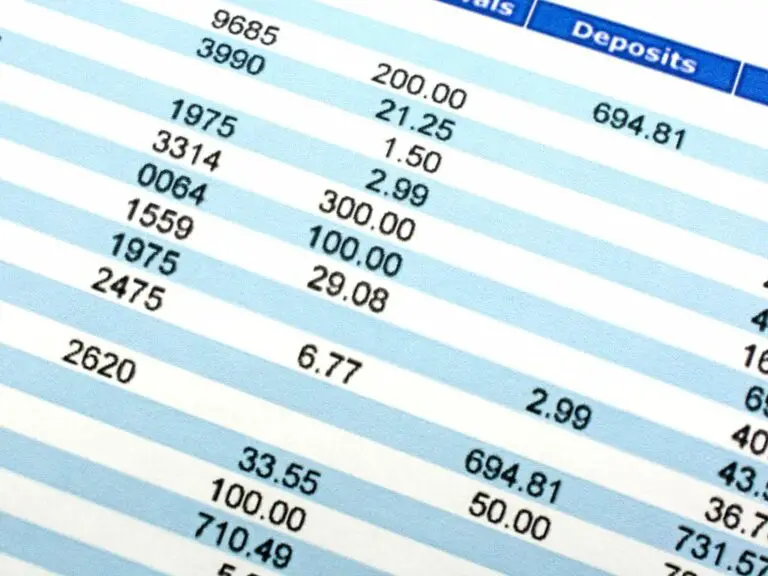

Bank statements are among the many documents that lenders will want to…

The main difference between a construction loan and a mortgage is that…

A lien and a mortgage are both legal claims against a property,…

This article explores the topic of mortgage payments, specifically concerning when they…

Are you looking for crime maps on Zillow? Zillow does not provide…

Are you curious about the annual tax amount on Zillow? Well, I’ll…

Are you curious about how many saves on Zillow are considered “good”…

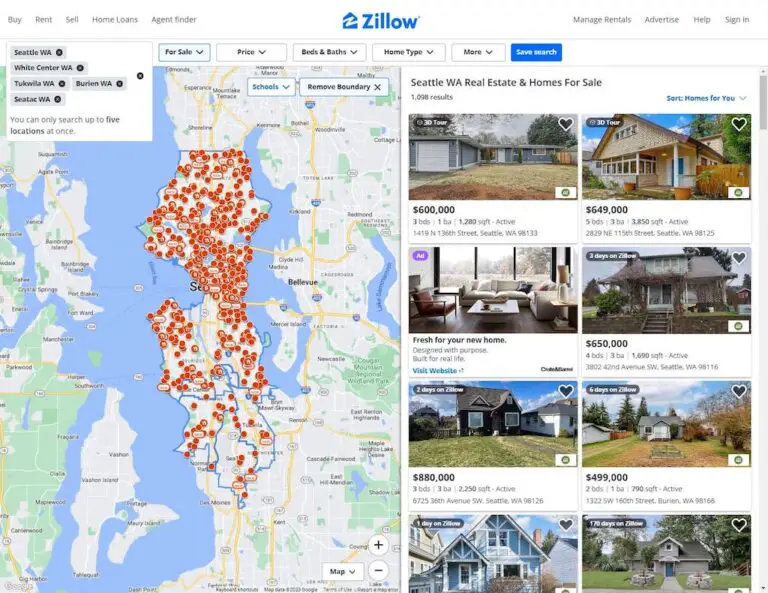

Zillow is one of the most popular online real estate marketplaces, providing…

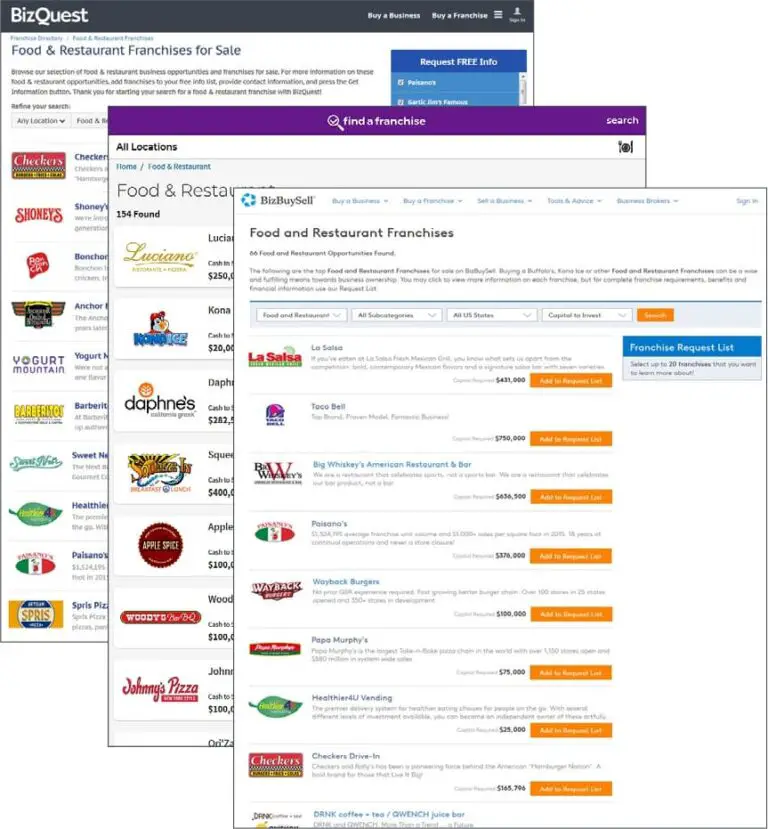

Are you looking for a platform that can help you evaluate the…

Zillow is one of the most popular online real estate databases for searching…

Are you looking for your house on Zillow but can’t seem to…

A Victorian house is a style of residential architecture that was popular…

Have you been curious to know the value of your home? Did…

Taking out a mortgage to purchase a home is one of the biggest financial…

When taking out a mortgage, one common question homebuyers have is “Do I…

A mortgage interest rate refers to the percentage rate at which interest…

Purchasing a home is often the largest financial investment most people make…

JPMorgan Chase Bank offers many conveniences to its clients, such as cashback…

To know what is a good mortgage interest rate, one must include…

When applying for a mortgage, one of the most important decisions you will…

A mortgage is a loan used to purchase a home or other…

A mortgage is a long-term loan used to finance the purchase of real estate.…

Buying a home is one of the most important decisions you’ll ever…

A mortgage broker acts as an intermediary between borrowers and lenders to…

Every once in a while, a loan company comes and shakes things…

When you want to become a mortgage broker, the first thing you…

Finding the perfect mortgage brokerage to help you obtain a good home…

FHA loans are available if you’re unable to obtain a conventional mortgage,…

A credit score is a crucial aspect when you want to apply…

Finding the perfect company when you want to buy a home or…

A mortgage is a loan used to finance the purchase of a…

When deciding to take a loan for a new home, there are…

You’ve probably heard many scary stories about having debts after getting a…

If you are in active military service, a veteran, or an eligible…

A VA mortgage is a home loan guaranteed by the U.S. Department…

Have you been thinking of dipping your toes in the mortgage business?…

Nowadays, we’re used to doing everything from the comfort of our homes.…