Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

If you wish to know does Rocket Mortgage do FHA loans, you came to the right place. We will answer all your questions regarding FHA and Rocket Mortgage loans.

Check out our guide, learn how Rocket Mortgage pre-approval works, what it means, and how you can get started.

Does Rocket Mortgage sell their loans to investors, or do they cover all the financing themselves? Here's everything you need to know about this topic.

If you want to know how are mortgage points paid, you came to the right address. This guide will tell you all there is to know about discount points.

Getting a loan is a process, but how long does a mortgage application take? Learn more about the duration and requirements of your loan application here.

Understanding the cost of mortgage insurance is an important part of the…

You wish to know if escrow tax property tax? Well, you came to the right place - here you will find out all you need to know about escrow.

Are you wondering: how do I get my mortgage deed? All you need to know is thoroughly explained in this article.

Does a mortgage expire? If you’re planning to buy a house soon and see a mortgage loan as the way of doing so, ensure to find out the answer.

Mortgage as a topic is not common knowledge. If you wish to learn more, going through the best mortgage books is your safest bet - and here they are.

If you’re planning to buy a home soon, find out if you can finance a mortgage down payment and how to do so to achieve the best possible outcome.

When is the best time to apply for a mortgage? Find out the answer so you can get only top service and rates when you decide to take this step.

Does mortgage insurance go away? Loans and all the costs that go with them are pricey, so many look to cut their costs in any way possible.

Do mortgage lenders use FICO to evaluate your credit score? If you're looking for a loan, providing the lender with your credit history is a must, and here is how this works.

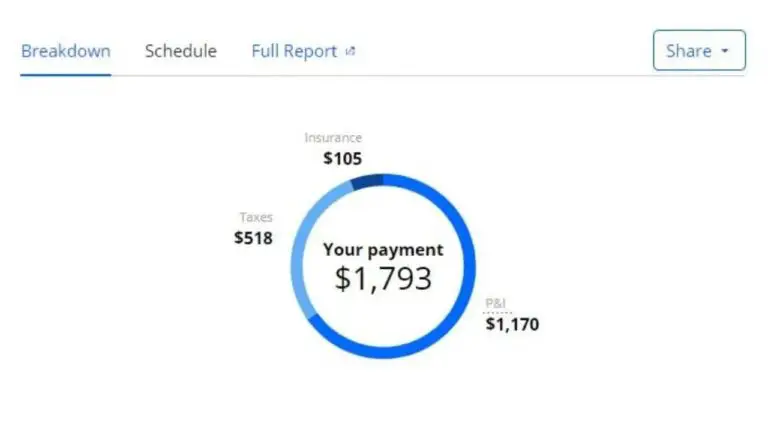

A mortgage payment is the amount you pay each month to service…

Getting approved for a mortgage is an important step in achieving homeownership.…

Mortgage closing costs are the various fees associated with finalizing a home…

When getting your credit score checked, your credit history, payment history, and…

There are a myriad of mortgage companies, and they all share a…

Looking for a way to get a quick mortgage loan? Movement Mortgage…

Property taxes occur to every homeowner. Sometimes they can be expensive based…

Getting mortgage insurance is an extensive process. Even if you own a…

A hard inquiry is when a financial institution like a mortgage lender requests your…

Mortgages are one of the most common methods of financing home purchases…

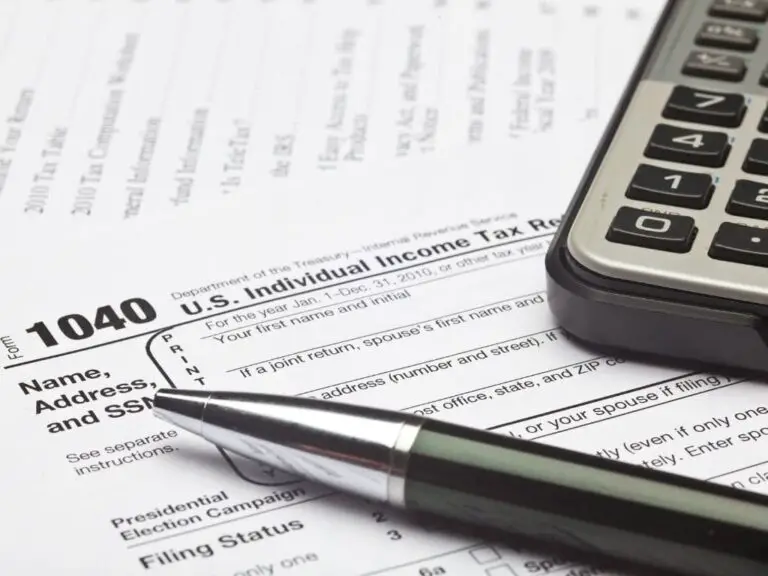

Tax returns refer to the forms and documentation filed with the Internal…

Purchasing a home is often the biggest financial investment an individual or…

A reverse mortgage allows eligible homeowners aged 62 and older to convert part of their home equity into cash without…

Saving for a mortgage down payment is an important step in the…

A mortgage is likely the largest loan you’ll ever take out in…

A voluntary lien is a type of lien that a property owner…

If you're buying a new home, one of the most common questions will be: are property taxes included in a mortgage? Here is a definitive guide with all the answers.

Is a mortgage a deed of trust? If you are in the process of getting loan approval and want to know all the essential details, check out my simple guide.

Are you thinking about buying a house or property and want to know is mortgage a loan? We have explained the main difference, so you don't have to dig.

Are you planning to buy land and wonder can you mortgage land? Find out the answer to this and many more questions you may have.

Learning how to pay off a 30-year mortgage in 15 years will help you avoid spending your hard-earned money on interest.

If you're looking for a loan, then you'll have to know what is a comparison rate mortgage, why is it important, and how it can help you learn the true cost of a loan

Do you know what a mortgage broker does and what their role in the loan application process is? If you're buying a home, here are all the answers you need.

The primary question “How much mortgage can I afford?” is an important…

A mortgage is a loan used to purchase real estate, with the…

One of the best-known insurance policies new homeowners have to pay is…

A credit history refers to a record of how an individual has…

A mortgage agreement is a legal contract between a lender and a…

During a close on a mortgage loan, you may hear the words…

Buying a home is an exciting milestone in life. However, the process of buying real…

The escrow account is an integral part of the mortgage process. When you take out a…

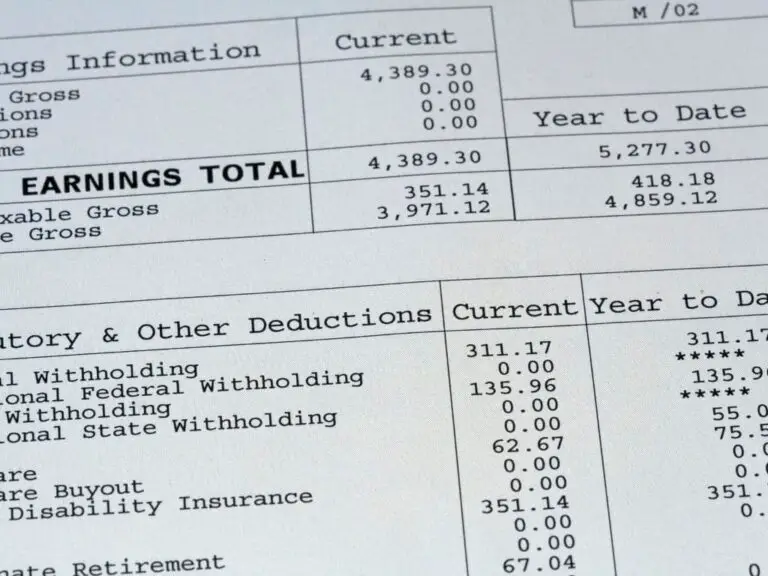

For many homeowners, the monthly mortgage payment can be confusing, with multiple components like…

Mortgage assumption is the process of legally transferring an existing mortgage loan…

Taking out a mortgage when purchasing the house of your dreams is…

If you have already done your research, you know that finding the…

A mortgage is a loan used to finance the purchase of a…