Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Taking out a mortgage when purchasing the house of your dreams is a risk that needs a lot of thought due to the complexity of the purchase and the sheer volume of factors you have to consider. We, as humans, can do so much, so it is wise to opt for a Zillow mortgage calculator that will do the sophisticated calculations instead of us. While there are many such calculators, the Zillow one is arguably the most popular choice among users.

But how accurate is the Zillow mortgage estimate? Zillow Mortgage Estimate is not 100% accurate. The algorithm used by Zillow to generate the mortgage estimate has some flaws, so it should only be used as a rough guide. However, it can still be helpful in getting an idea of what your mortgage payments might be.

Zillow’s mortgage estimate is based on public data and current market trends.

It is not a guarantee of your final mortgage rate or monthly payment. To get an accurate estimate of your mortgage rate and monthly payment, speak to a loan officer.

It is impossible to define the main reasons for the flawed Zillow’s system in a couple of sentences. I am taking it upon myself to explain the Zillow mortgage calculator functions and how you can get a relatively accurate representation of an estimated monthly mortgage payment.

Are Zillow monthly estimates accurate? Zillow’s monthly estimates are not accurate. Zillow’s monthly estimates are based on a computer algorithm that looks at recent sales in a neighborhood and then tries to estimate the value of every home in that neighborhood. However, there are many factors that can affect a home’s value, and the algorithm is not always able to take these factors into account.

So the estimates may be inaccurate.

Additionally, the algorithm can be affected by changes in the real estate market, so the estimates may change from month to month.

By the end of the article, you will have learned everything you need about how accurate the mortgage calculator of Zillow is. Let’s dive into this topic already!

As I already mentioned, the Zillow mortgage calculator can be way off due to the inability of the calculator learning model to examine fundamental aspects that determine the final result.

On the surface, this Zillow mortgage estimator has a neat and simplistic design and seems like a helpful mortgage calculator that will do solid work for you. It promises to estimate your total mortgage payment, including principal and interest.

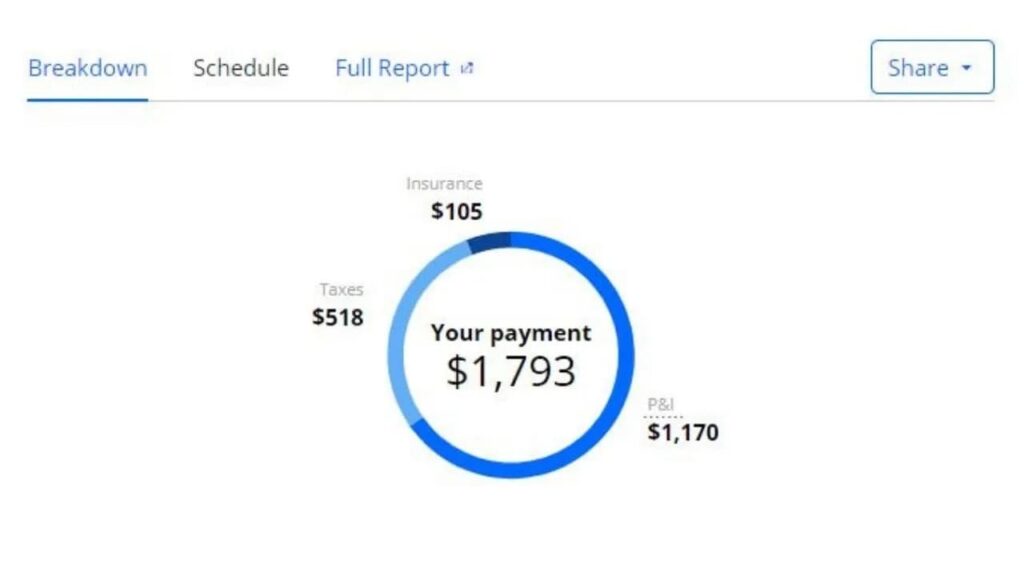

This is not the only feature the mortgage payment calculator of Zillow will provide you with, but you will also receive detailed information about your potential

Many users ignore these costs when looking for estimations on their monthly mortgage payment, which may be detrimental if they base their decision solely on the calculator results.

In reality, these costs represent a rather substantial part of the actual payment, so you should not neglect them. The inclusion of these additional fees should mean that the Zillow mortgage calculator is, in fact, accurate.

Unfortunately, this isn’t the complete picture. There is one main flaw with the calculator itself, and it refers to the down payment. If you enter a down payment that is 20% or higher, you will quickly notice that the mortgage calculator Zillow doesn’t register it at all.

If you were to enter a number below 20, the calculator would readjust its calculations and visualize a mortgage estimate that accounts for the down payment and loan payment.

I also recommend that you be careful with the insurance and taxes, as it seems that the Zillow mortgage calculator always underestimates these costs.

Due to the low insurance and tax estimations, the resulting number is lower than it should be. The Zillow calculator mortgage estimates toward the top of individual listing pages on Zillow are off because of the miscalculations.

I should point out that you can find a more accurate number for your mortgage payment. You can see it at the bottom of the listing page on Zillow. The improved accuracy is because the number is taken directly from the county assessor’s office in the “Price and tax history” section.

The inconsistencies and the frequent underestimations of the tax and insurance fees prove that the Zillow mortgage calculator is unreliable. While it will provide you with a general estimate regarding your monthly mortgage payment, you shouldn’t rely entirely on the Zillow mortgage estimate. The result will only be as good as the information behind it.

Zillow calculates estimated payments by estimating the monthly principal and interest payment that would be required to fully pay off the mortgage over its lifetime. The estimate also includes monthly taxes, insurance, and HOA fees, as well as any applicable PMI (private mortgage insurance).

There’s also a feature – Zillow monthly payment calculator that also accounts for the fact that a portion of each monthly payment goes towards reducing the principal balance of the mortgage.

Over time, this gradual decrease in the principal balance results in a smaller total amount of interest being paid over the life of the loan.

Zillow’s estimated payment takes all these factors into account, so it provides a realistic estimate of what your actual monthly mortgage payment would be.

The Zillow Estimated Payment is not entirely accurate. It’s calculated using a computer algorithm based on public data and market trends, but it often underestimates costs such as insurance and taxes. Furthermore, it may not accurately account for down payments above 20%. Therefore, it should be used as a rough guide rather than a definitive figure.

Zillow’s Estimated Payment calculation takes into account your mortgage loan amount, interest rate, and the expected taxes and insurance for your geographic area. The Zillow mortgage payment calculator also accounts for the fact that your monthly payment will likely change as interest rates rise or fall.

The Estimated Payment calculation is designed to provide you with a realistic estimate of what your monthly mortgage payment would be on a given property. So, consider the mortgage loan calculator Zillow offers and manage your finances like a pro.

What is Zillow’s estimated payment based on and does it include HOA? Yes, Zillow’s estimated payment includes HOA (Homeowners Association) dues. This is because HOA dues are considered part of your monthly mortgage payment. So, when you’re looking at Zillow’s estimate of your monthly mortgage payment, it will already include the HOA dues.

Redfin’s mortgage estimate proves to be slightly more accurate in comparison to the Zillow mortgage calculator gives you. Redfin also has more accurate price information.

Thanks to more up-to-date property listing information and more frequent updates, this mortgage calculator will provide you with a realistic representation of your monthly mortgage payment.

If you plug in the numbers and compare the results, you will find out that Redfin will always present you with a higher mortgage estimate than Zillow, which also turns out to reflect the actual monthly payment more often than not.

This is one of the questions you definitely need the right answer to. Finances should be taken seriously, especially since there could be some additional fees that are frequent miscalculations and untrustworthy representation that could make up the monthly mortgage payment. This also proves that the Zillow mortgage estimate is not a trustworthy factor to base your decision on.

You will be better off reaching out to a proper professional who will provide you with sufficient information on the matter. This way, you won’t put yourself in a position to make a mistake.

However, the Zillow mortgage estimate is enough to give you a clear understanding of how your finances stack up or whether you can afford the monthly mortgage payment or not. It is still an effective tool, so don’t disregard it when doing your research.

When it comes to meaningful decisions, purchasing a home is at the top of this list. That’s when the Zillow home calculator steps in because taking out a mortgage is a serious investment and, in some instances, a massive financial risk.

So, the first thing to do is have an answer to the following question: ”Is the Zillow mortgage estimate accurate?” We always want to be on top of things and do our best to consider all factors that may influence the mortgage payment. A Zillow payment calculator comes in handy in such cases, thanks to their ability to make complex calculations while examining specific fees.

People tend to rely way too much on technologies, and this frequently puts us at a disadvantage. The Zillow mortgage calculator is one of the most popular mortgage calculators among users, but it still has some flaws in its algorithm.

The Zillow mortgages calculator doesn’t provide us with accurate enough calculations when it comes to visualizing a realistic monthly mortgage payment. The unreliable result may lead us to make a risky financial decision, which is likely to prove disastrous.

Take the Zillow mortgage estimate with a grain of salt, and don’t make crucial decisions based on a single number.