Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

If you are planning to become a homebuyer soon, you probably want to know when to submit a loan application. So, when is the best time to apply for a mortgage?

The best time to apply for a mortgage is in the first few days of a month because you’re more likely to get better service then. However, your credit score, income, and financial situation are all included in determining your mortgage rates. Therefore, the right time for applying is when they are the best they can be.

Did you know that more than 60% of Americans carry a mortgage? Learn how to get the best deal for yourself as well as how to make the approval process a better experience.

The right timing for submitting your request is connected to the business cycle your lender has. The good news is that many creditors and companies follow the same principle:

That doesn’t mean that you must apply at the beginning of a month, just that you’re bound to get better service if you do so. It’s the period when lenders are also seeking new borrowers, so they will be more than willing to help you go through the home loan possibilities and rates with them.

On the other hand, mortgage brokers and loan officers need to close loans and meet monthly targets before the month ends. Did you know that a mortgage note needs to be signed in the same month it’s composed? Therefore, creditors can’t provide you with the same attention they would if you applied earlier.

Simply put, lenders will acquire applications whenever a buyer decides to deliver them. However, different times of the month will most likely dictate the priority of your application and the number of days needed for your request to be processed.

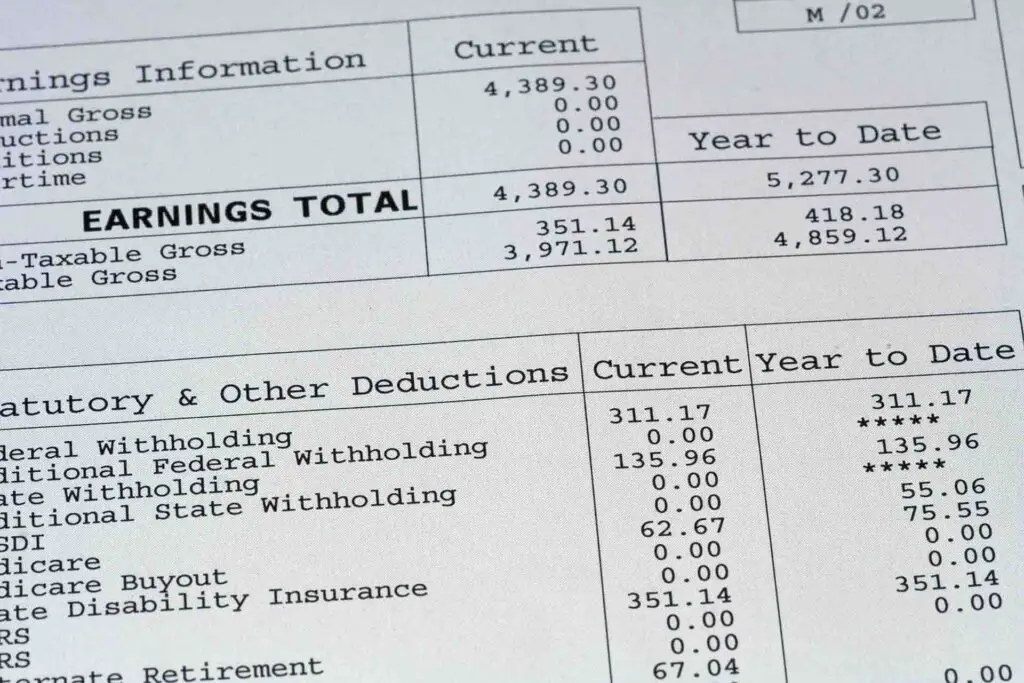

If you want to shorten the period between applying and getting an offer, it’s always smart to have all financial documentation already prepared. So you can speed up the process, ensure that you collect:

Gathering these documents in advance and sending them all together is bound to speed up the process and, thus, improve your experience.

To improve the chances of getting approved and being presented with better rates, you need to have at least a good credit score. Before making an offer, each lender will go through your score to see if you’re suitable for the loan you want.

Remember – the better score you have, the less of a risk you represent for a creditor. Luckily, your creditworthiness can improve if you pay off debts, don’t miss new payments, don’t get new loans, and so on. If there is a possibility for it, it’s always better to improve your score before applying.

When making a credit inquiry, almost all lenders will use FICO scores – three-digit numbers that can range from 300 to 850.

The table below will clarify the process:

| Data categories | Main question | Importance in the final calculation |

| Payment history | Do you pay your installment regularly? | 35% |

| Amounts owed | How much debt do you have on all accounts? | 30% |

| Length of credit history | For how long do you have each of your accounts? | 15% |

| New credit | Have you opened several accounts in a short period? | 10% |

| Credit mix | What types of accounts have you opened? | 10% |

Based on this report, your FICO score will be determined. A lender will then assess your request, decide if it will be officially accepted, and determine the rates and terms of your mortgage.

By assessing your income, creditors will be able to deduct if you can afford monthly payments. It’s usually considered that a person can afford a mortgage which is up to three times their income. For borrowing $240,000, for example, your income should be approximately $80,000.

One of the most important things creditors consider when deciding on an application is the debt-to-income ratio. It shows how much of your total gross monthly income goes to paying debts and other loans.

The exact percentage will vary based on your lender and the home loan you want. Generally, different financial obligations shouldn’t take more than 36% of your monthly income. That is why you need to repay as many loans as possible before applying.

Not having enough money to put down can often postpone the process of buying. Note that bigger down payments mean better rates for you. Lower down payments (under 20%) will increase your monthly installments. Moreover, they often imply paying the costs of private mortgage insurance as well.

Therefore, it’s always better to wait for a little while and save up more money to put down before applying. The other solution is getting financial help from a friend or family member – just remember that creditors will demand proof that the money is gifted, not borrowed.

Lenders don’t want to risk missed payments, so unstable employment isn’t something they consider favorable. So, if you’ve changed jobs not long ago, you may want to wait a couple of months (or even years) before applying.

If you’ve started a different job recently due to career advancement, avoid misconceptions – ensure your creditor is notified about it.

Applying for a mortgage is connected with more than just numbers on paper. Besides the secured down payment, stable income, and good credit score, there are other things to think about. Are you ready to tie yourself to one property? Can you limit your spending so that monthly installments can be more bearable? Getting a mortgage and buying a home for many means changing their lifestyle – and you need to be sure that you are ready for it.