Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Do you know if you have to pay your mortgage insurance monthly or annually? Understanding the payment schedules for your mortgage insurance is indeed a tricky task. But don’t worry; I’ve tried to make it easier for you. Is mortgage…

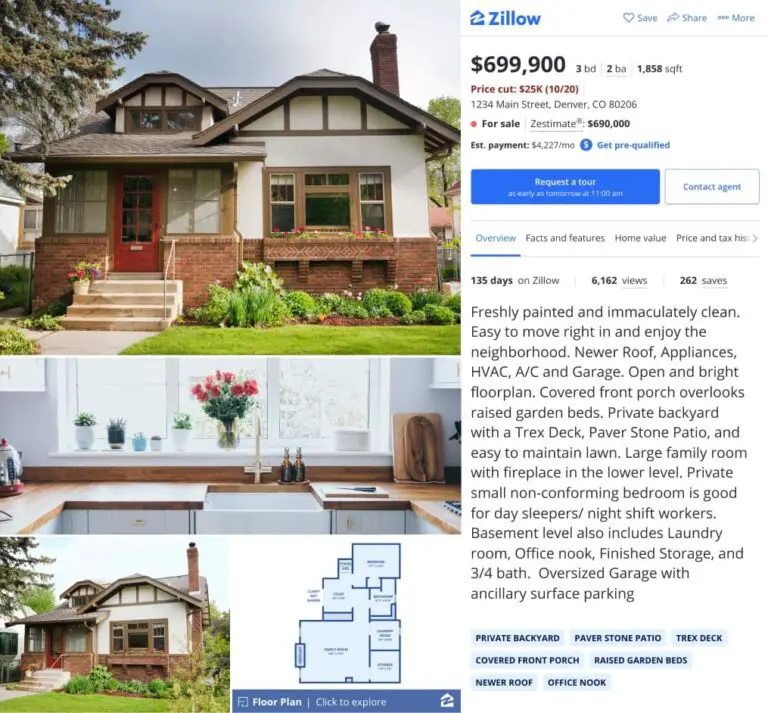

Wondering if you should stick to Zillow to get accurate estimates of property prices or opt for something else? Redfin is more accurate than Zillow when it comes to calculating the price of a property based on location, sales history,…

Taking out a mortgage to purchase a home is one of the biggest financial decisions most people will make in their lifetimes. Understanding how mortgage interest works is crucial to making an informed decision when shopping for a home loan. One common question homebuyers…

Purchasing a home is often the largest financial investment most people make in their lifetimes. With mortgage loans being a necessity for many homebuyers, it is crucial to understand the components of a mortgage, especially the interest payments. The interest…

A mortgage is a loan used to purchase a home or other real estate. The interest rate on a mortgage determines how much you will pay in interest over the life of the loan. Understanding how mortgage interest is calculated…

A mortgage broker acts as an intermediary between borrowers and lenders to help borrowers find and obtain mortgage loans. Using a mortgage broker can provide convenience and expertise, but also comes with fees and costs that borrowers should understand. This…

When deciding to take a loan for a new home, there are numerous fees that you can be charged as part of your closing costs, and one of those fees could be mortgage broker fees. But what are these fees,…

Taking out a mortgage to finance a home purchase is one of the biggest financial decisions you’ll make in life. Before applying for a home loan, it’s crucial to understand how much house you can afford and what your estimated…

When you are in the process of applying for a mortgage loan, one of the first documents you will receive from your lender is a mortgage loan estimate. This detailed estimate breaks down the estimated costs associated with your loan, including the interest…

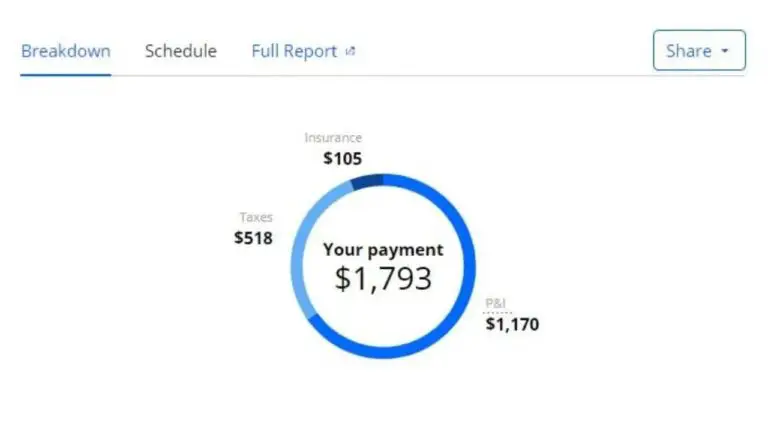

Mortgage calculators have become useful tools for assessing your financial situation and capabilities before applying for a loan. However, they have certain disadvantages that mustn’t be overlooked and it is important to know what the most accurate mortgage calculator is.…

Buying a home is a complex process, and understanding every part is essential. Here's all you need to know about Rocket Mortgage closing costs.

Understanding the cost of mortgage insurance is an important part of the home buying process for many homeowners. Mortgage insurance has a significant financial impact, so it’s essential to know how it works and how much it costs. The cost…

A mortgage payment is the amount you pay each month to service your home loan. This includes principal, interest, taxes, and insurance. Lowering your mortgage payment can free up room in your monthly budget and help you achieve financial goals…

Mortgage closing costs are the various fees associated with finalizing a home loan. These costs are paid at closing and can add thousands of dollars to the total cost of buying a home. According to data from ClosingCorp, the average closing…

Mortgages are one of the most common methods of financing home purchases in the United States. For many homeowners, their mortgage is their single largest debt. Paying off a mortgage faster can have major financial benefits, allowing homeowners to own…

Learning how to pay off a 30-year mortgage in 15 years will help you avoid spending your hard-earned money on interest.

The primary question “How much mortgage can I afford?” is an important one for homebuyers to consider carefully. Assessing one’s financial situation and determining a suitable and manageable mortgage amount is essential for responsible homeownership. There are several key factors…

Taking out a mortgage when purchasing the house of your dreams is a risk that needs a lot of thought due to the complexity of the purchase and the sheer volume of factors you have to consider. We, as humans,…

Paying off your home mortgage early can save you thousands of dollars in interest payments over the life of your loan. With focused effort and disciplined saving, you may be able to pay off your 30-year mortgage in just 5…