Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Purchasing a home is often the biggest financial investment an individual or family will make. The mortgage loan application process requires applicants to thoroughly demonstrate their financial reliability to lenders. A critical component in illuminating income and verifying financial stability is submitting pay stubs. Determining how many pay stubs are typically required by mortgage lenders can facilitate a smooth loan application process.

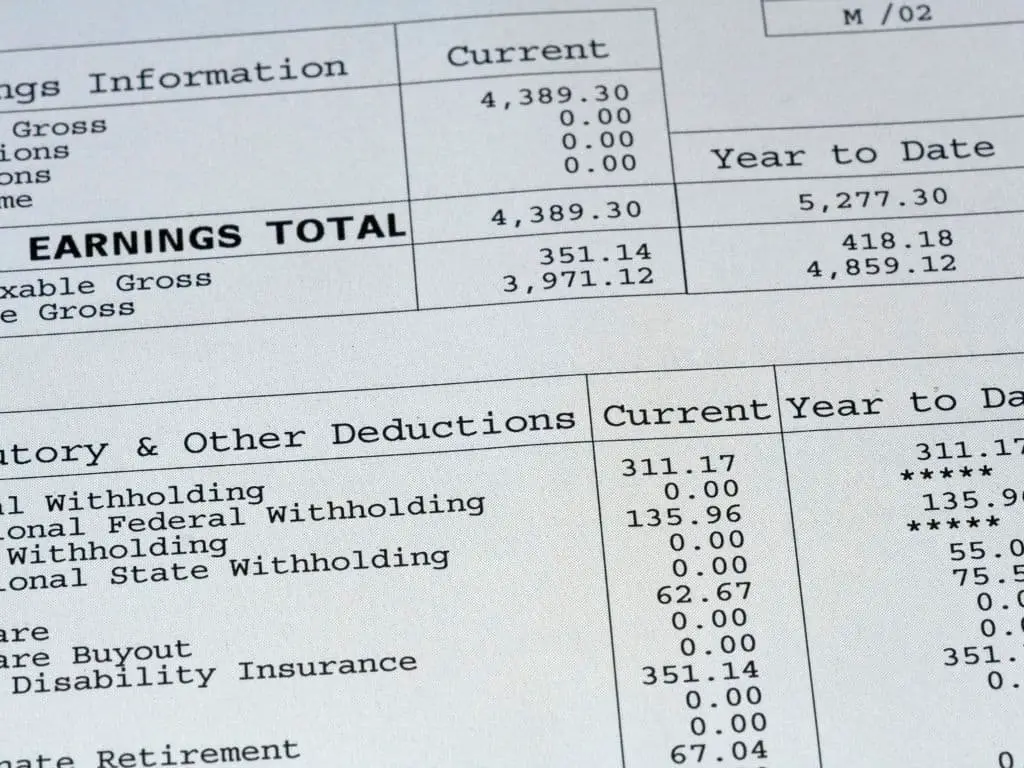

Pay stubs constitute important documents that provide proof of an applicant’s regular earnings. They contain detailed information about the income, taxes, deductions, and net pay an individual has received from their employer. Reviewing an applicant’s pay stubs allows lenders to evaluate their financial stability and capacity to manage mortgage payments over time.

Given the significance of pay stubs for underwriting mortgage loans, most lenders require applicants to submit multiple pay stubs. However, there is no universal standard for the precise number needed. The major factors determining requirements include the lender, loan program, and applicant’s employment specifics. While variance exists between lenders, common practices have emerged.

Pay stubs are documents prepared by employers that provide employees with a record of their earnings and deductions for a particular pay period. They typically display details such as the employee’s name, pay date, number of hours worked, wage rate, taxes withheld, net pay, and year-to-date totals.

For lenders evaluating mortgage applicants, pay stubs fulfill a critical role in validating and assessing income. Reviewing pay stubs enables lenders to verify applicants’ employment and stability of income over the previous months. This provides pivotal insights into applicants’ ability to manage mortgage payments in the months and years after loan approval.

Beyond income verification, pay stubs also allow mortgage lenders to:

Because pay stubs provide such an extensive picture of applicants’ finances, they are indispensable for mortgage approvals. The forthcoming sections explore specifics around lenders’ requirements for pay stubs during the application process.

Unlike other mortgage documentation such as tax returns or bank statements, no federal regulations dictate a standard number of pay stubs lenders must request from applicants. Most lenders require multiple consecutive pay stubs spanning the last 30-90 days. However, specific demands vary between institutions and loan programs.

Conventional loans from banks and lenders like Wells Fargo or Bank of America tend to require the last 30-60 days of pay stubs. For instance, if paid weekly, applicants may need to provide 6-12 pay stubs. If paid bi-weekly or semi-monthly, lenders often request 3-6 pay stubs as proof.

For loans backed by the Federal Housing Administration (FHA), guidelines generally recommend obtaining the most recent 30 days of pay stubs. Yet for borrowers paid bi-weekly or semi-monthly, some lenders accept just one pay stub.

VA loans through the Department of Veteran Affairs typically necessitate 2-4 weeks of pay stubs for weekly or bi-weekly borrowers. For semi-monthly or monthly pay periods, 2 pay stubs are often adequate.

USDA loans for rural housing usually align with conventional requirements of 1-2 months of stubs. Though self-employed borrowers may need to provide 12 months of pay stub documentation.

The mortgage lender’s evaluation of employment stability also influences specific pay stub requirements:

Essentially, the number of pay stubs needed comes down to illuminating a reliable picture of income. Applicants should be prepared to submit 30-90 days’ worth when completing mortgage applications.

Strategically organizing and submitting pay stubs helps streamline mortgage approvals by enabling lenders to efficiently validate income. Applicants should be thorough yet succinct when compiling pay stubs. Key tips include:

By precisely preparing pay stubs, applicants empower lenders to efficiently validate incomes and make timely mortgage decisions. Avoiding common mistakes like incomplete stubs, inconsistencies, or disorganization likewise facilitates quicker approvals.

While pay stubs provide critical income insights, lenders also require various supplementary documents to underwrite mortgage loans:

Though pay stubs offer indispensable monthly income insights, these additional documents provide critical context on overall financial standing. Thoroughly compiling all documentation accelerates mortgage approvals by giving lenders a comprehensive financial profile.

While gathering pay stubs and financial statements is a major hurdle, the mortgage application process involves several succeeding stages:

Initial documentation review – Lenders confirm all required documents are submitted and evaluate contents. Additional pay stubs may be requested to clarify any inconsistencies spotted.

Verification of employment – Lenders contact employers directly to authenticate applicants’ employment status, titles, incomes, and other job specifics pertinent to underwriting decisions.

Credit checks and history review – Lenders thoroughly evaluate applicants’ credit scores and credit histories from reports compiled by agencies like Experian, Equifax, and TransUnion. Poor credit can jeopardize mortgage eligibility.

Debt-to-income calculations – Lenders assess ratios of debt to income, often limiting mortgage approval to applicants with 43% or lower debt-to-income levels. Pay stubs assist in making accurate calculations.

Appraisal and inspection – The lender arranges appraisal and inspection of the property being financed to ensure sufficient property value to secure the mortgage.

Final eligibility assessment – Only after validating all documents, credit histories, ratios, and appraised property values will lenders make final determinations on an applicant’s mortgage eligibility and terms.

While intensive, this level of due diligence by lenders protects applicants by ensuring only affordable, sustainable mortgages are approved.

For mortgage applicants, pay stubs are indispensable for illuminating income and gaining loan approval. Most lenders require 1-3 months of consecutive pay stubs, though exact requirements vary. Efficiently organizing and preparing multiple pay stubs facilitates the mortgage process by enabling lenders to smoothly validate incomes. By coupling pay stubs with other key financial statements, applicants empower lenders to make prudent, timely mortgage decisions. While gathering documentation is arduous, it institutes essential protections for borrowers and forms the foundation for mortgage approvals.